Unfortunately, data breaches are now normal, everyday occurrences in our society. As a result, many companies are offering services to help you protect your personal information. If you want an extra layer of protection, an identity theft protection service is a good option. However, the term "identity theft protection service" can be misleading. The reality is that no one service can safeguard all of your personal information from identity theft. What most of these companies actually provide are identity theft monitoring and recovery services.

A monitoring service will watch for signs that an identity thief may be using your personal information. This typically includes tracking your credit reports for suspicious activity and alerting you whenever your personal information (e.g., Social Security number) is being used. The recovery portion of the service usually helps you deal with the consequences of identity theft. This often involves working with a case manager to help resolve identity theft issues (e.g., dealing with creditors or placing a freeze on your credit report). And depending on the level of protection you choose, the service may also provide

reimbursement for out-of-pocket expenses directly associated with identity theft (e.g., postage, notary fees) and any funds stolen as a result of the identity theft (up to plan limits).

Identity theft protection services usually charge a monthly fee. Entry-level plans that provide basic protection (e.g., Social Security number and credit alerts) can cost as little as $10 a month, while plans that offer more advanced features (e.g., investment account monitoring) will cost more.

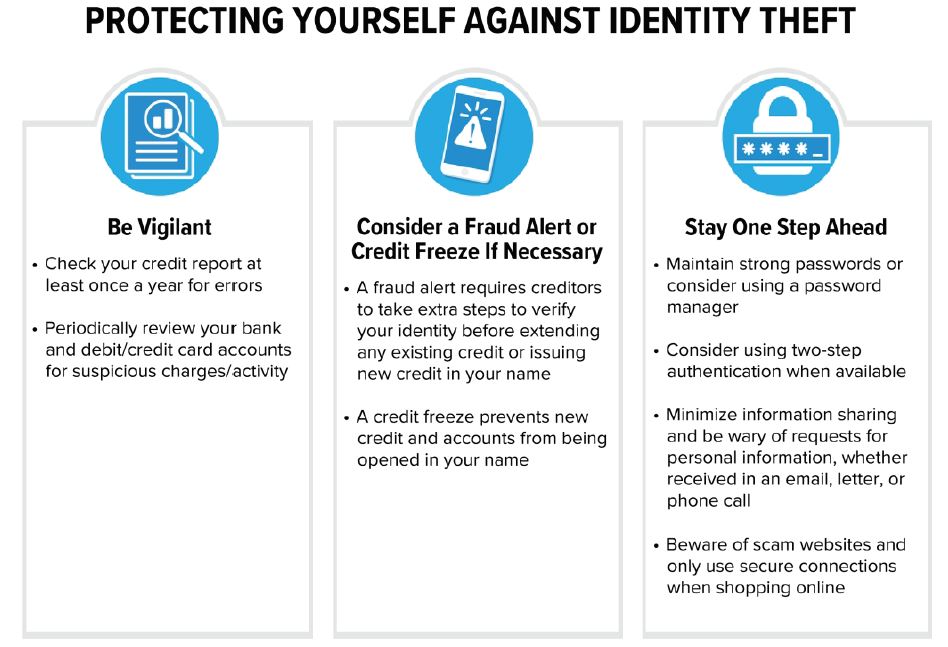

Keep in mind there are steps you can take on your own to help protect yourself against identity theft, such as:

- Check your credit report at least once a year for errors

- Periodically review your bank and debit/credit card accounts for suspicious charges/activity

- Obtain a fraud alert or credit freeze if necessary

- Have strong passwords, use two-step authentication, minimize information sharing, and be careful when shopping online

Broadridge Investor Communication Solutions, Inc. does not provide investment, tax, legal, or retirement advice or recommendations. The information presented here is not specific to any individual's personal circumstances.

To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances.

These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable — we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.