When you're looking for details, start your search here. You need the right information to make important financial decisions, and we're committed to delivering.

The current balance on your account is the balance from the close of business the previous day. It is the balance that we start with at the beginning of the business day. The available balance is what is actually available for withdrawal in your account. It takes into account any pending deposits or credits you may have as well as any holds/floats on the account. The available balance is always the balance that you want to use when using the funds in your account.

Client may register for the Mobile App by visiting first.bank and choosing the app links at the bottom of the website OR they may go to the app store on their mobile device and search for First Banks Biz to Go.

Please contact our First Bank Service Center at 1-800-760-2265 option 2 or your local branch to get a dispute started on an unauthorized debit card charge. Visit our Locations page to find a local branch closest to you.

Yes, please visit our Credit Cards page to learn more and fill out an application online.

1. To help the government fight the funding of terrorism and money laundering activities, Federal law requires us to obtain, verify, and record information that identifies each person acting as an authorized signer or is a Beneficial Owner of the entity. When you apply for an account, we will ask for the name, residential address, date of birth and other information that will allow us to identify those individuals designated as authorized signers and Beneficial Owners. In addition, we will require a valid (unexpired) Primary Identification for each individual.

Acceptable Primary Identification

- U.S. Driver’s License

- U.S. State ID

- U.S. Military ID

- Resident Alien/Permanent Resident Card

- Passport

- Matricula Consular ID Card

- Guatemala Consular ID Card

- U.S. Visa Border Crossing Card

Note: If the address on the Primary ID is not the individual’s current residential address, or the ID does not display a residential address, a passport for example, additional documentation is required to show the current residential address. This might include, but is not limited to, a utility bill or lease.

2. Information regarding the individual Beneficial Owners of the business. Beneficial Owners are those who own, directly or indirectly, 25% or more of the equity interests of the business. This information is collected to help fight financial crime.

3. Registration documents from the state where you registered your business in addition to documentation regarding the type of business entity you own. Contact your local First Bank branch for further information.

To help the government fight the funding of terrorism and money laundering activities, Federal law requires us to obtain, verify, and record information that identifies each person who opens an account. When you apply for an account, we will ask for your name, residential address, date of birth and other information that will allow us to identify you. In addition, we will require a valid (unexpired) Primary Identification.

Acceptable Primary Identification

- U.S. Driver’s License

- U.S. State ID

- U.S. Military ID

- Resident Alien/Permanent Resident Card

- Passport

- Matricula Consular ID Card

- Guatemala Consular ID Card

- U.S. Visa Border Crossing Card

For minors, Driver’s Permit with picture; Birth Certificate when other forms of ID are not available.

Note: If the address on the Primary ID is not the individual’s current residential address, or the ID does not display a residential address, a passport for example, additional documentation is required to show the current residential address. This might include, but is not limited to, a utility bill or lease.

1. To help the government fight the funding of terrorism and money laundering activities, Federal law requires us to obtain, verify, and record information that identifies each person acting as an authorized signer or is a Beneficial Owner of the entity. When you apply for an account, we will ask for the name, residential address, date of birth and other information that will allow us to identify those individuals designated as authorized signers and Beneficial Owners. In addition, we will require a valid (unexpired) Primary Identification for each individual.

Acceptable Primary Identification

- U.S. Driver’s License

- U.S. State ID

- U.S. Military ID

- Resident Alien/Permanent Resident Card

- Passport

- Matricula Consular ID Card

- Guatemala Consular ID Card

- U.S. Visa Border Crossing Card

Note: If the address on the Primary ID is not the individual’s current residential address, or the ID does not display a residential address, a passport for example, additional documentation is required to show the current residential address. This might include, but is not limited to, a utility bill or lease.

2. Information regarding the individual Beneficial Owners of the business. Beneficial Owners are those who own, directly or indirectly, 25% or more of the equity interests of the business. This information is collected to help fight financial crime.

3. Registration documents from the state where you registered your business in addition to documentation regarding the type of business entity you own. Contact your local First Bank branch for further information.

First Bank currently supports: Apple, Google, and Samsung pay Digital Wallet services. Please visit our Digital Wallet page for more information regarding each service.

You may visit any local branch in person to close your account. Click here to find a branch closest to you. If you are not able to visit a branch in person, you may send a notarized letter to a branch indicating you would like the account to be closed and any remaining funds will be mailed to you.

First Bank currently supports: Apple, Google, and Samsung pay Digital Wallet services. Please visit our Digital Wallet page for more information regarding each service.

Client may register for the Mobile App by visiting www.first.bank and choosing the app links at the bottom of the website OR they may go to the app store on their mobile device and search for First Banks On the Go.

Yes, it's possible for your payment to change. If this occurred, it would be due to any fluctuations in the annual tax assessments to your property or any increase to your homeowner's insurance policy. Since both are paid monthly through your mortgage payment, any changes to either of these items would alter your payment. Please note, with a fixed rate home mortgage, your principal and interest payments will remain the same throughout the life of your loan.

There are many acceptable sources of funds that you can use for a down payment. The most common are: personal savings or checking account, gift from a family member, 401(k) account, and down payment assistance programs. A Mortgage Home Loan Advisor is there to assist you with these options and more.

A general rule of thumb for determining if you can qualify for a new mortgage is to use 33% of your gross monthly income for housing. The housing payment includes the monthly principal and interest on the mortgage, plus the property taxes and homeowners insurance. It is a good idea to also consider all the monthly amounts for car payments, leases, and revolving credit cards, plus the new housing payment at 38% of your gross monthly income. Our Mortgage Home Loan Advisors can easily assist you to ensure you are able to qualify for the home you are considering purchasing.

Getting a mortgage can seem a bit overwhelming. Using our online application, you have the ability to expedite the process and easily upload all your banking and income documents. Your Mortgage Home Loan Advisor will help your home loan experience go smoothly.

While it seems like one extra unnecessary step, a pre-approval strengthens any offer you make once you have decided on a home to purchase.

Generally you will need enough funds for your down payment, closing costs and two months of your new payment in reserves.

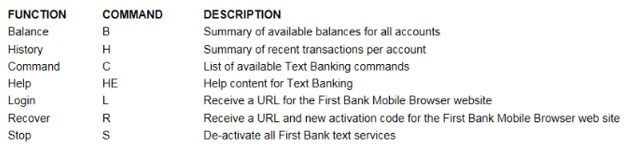

Clients can use the following list of text commands:

People Pay can be used to send money to any individual or business with a U.S Bank account and email address or mobile number. Use People Pay to pay a friend for lunch, pay your rent or send money to your college student or babysitter.

People Pay gives you a safe and secure way to quickly and easily send payments online or from your mobile phone.

People Pay allows you to send money in one of the following ways:

- Deposit to bank account. If you know the contact’s account number and the routing and transit number of the financial institution where the account resides, you can deposit money directly into that account. Your money is delivered in 1-3 days.

- Email Address/Mobile number. Allow the contact to decide how they want to claim the money. We will send an email or text message to your contact with the instructions explaining how to claim the money

- PayPal. Send money instantly using PayPal. If you know the email address associated with the contact’s PayPal account, you can deposit money directly into that account.

Log into www.first.bank. Select People Pay from the ‘Pay and Transfer’ tab at the top of the home page and follow the enrollment instructions. People Pay can also be accessed by clicking on the People

Pay icon located in the ‘Money Center’.

Once enrolled in People Pay, you can access via your mobile device using the First Bank on the Go app (clients must enroll in the People Pay service through First Bank’s eBanking before it can be accessed through the First Bank mobile app).

A new contact can be added by accessing People Pay through First Bank’s eBanking or through the First Bank on the Go mobile app. You will need to provide the contacts information, such as name, email address or mobile number and bank account information (optional).

No. If the person you are sending money to is not registered for First Bank’s People Pay, they will receive and email or text to claim the payment. You can also send People Pay payments to recipients by entering their routing and account number or by using PayPal.

To send money using an email address or text message, you need the name and email address or mobile phone number of the recipient.

To deposit funds directly to a bank account, you need the recipient’s name, bank account number and bank routing number.

To send funds instantly using PayPal, you need the recipient’s name and email address associated with their People Pay account.

Payments sent using routing and account number or PayPal payments are received in one to three business days. Payments sent after 9:30 PM CT are processed the next business day. For example, if you use People Pay to pay your friend for dinner on Friday night at 10:00 PM CT, the payment is processed on Monday.

Payments sent using email or phone number are received one to three business days after the recipient claims the payment. Recipients have 10 calendar days to claim their payment.

If you send the payment using the recipients routing and account number or send via PayPal, the funds are debited immediately after you send the payment.

Payments made using email or phone number are debited from your account when the recipient claims the payment. If the recipient does not claim the payment after 10 calendar days, the funds are not deducted from your account.

Yes, there is a per transaction limit of $2,000 and a per business day limit of $4,000

Payments sent to a mobile number or email address can be cancelled by accessing People Pay through eBanking or the mobile app as long as the recipient has not claimed the payment. If the money has been claimed, you are unable to cancel.

Money sent using the recipients account information or PayPal cannot be cancelled.

Yes, payments can be tracked by accessing People Pay through the eBanking or the mobile app.

Yes, there is a .50 per transaction fee (only applies to successful transactions).

No, payments can only be sent to individuals with U.S. based financial institutions or credit unions.

The person receiving the money will be sent a notification to the email or phone number you entered in People Pay for the contact with instructions on how to claim it. You will be notified of the payment status to your primary email.

Recipients will follow the instructions sent in the text message or email address. The recipient will decide what account they would like their funds deposited into.

People Pay users, can set up a preference to have all incoming People Pay payments deposited into a single account. Once the recipient enables this feature, they will receive an email or text message indicating the incoming payment was automatically deposited into the selected bank account. This People Pay feature makes it faster and easier for recipients to receive their money.